Effective Planning, Practical Tips, and Top Free Personal Finance Tools for 2025

Thursday, February 6 2025 3:49 pm

By John Ssenkeezi - Digital Supervisor Follow on LinkedIn

One area that consistently takes centre stage in goal-setting is money. The financial landscape is evolving in ways that are both exciting and challenging, leaving individuals eager to set (and keep) strong financial resolutions. Goals to save more, reduce debt, or invest intelligently are common, yet translating these ambitions into actual achievements is easier said than done. This is because achieving financial resolutions now requires not merely good intentions but also a robust strategy. This is where careful planning and thoughtful use of modern personal finance tools become essential.

Why Planning Matters for Financial Resolutions

1. Clarity and focus

Well-defined goals allow you to focus your energies on what truly matters, ensuring that every shilling spent aligns with broader objectives. Instead of operating in a vague mental space — where you know you want to save but do not quite know how much or for what purpose — planning forces you to assign tangible figures and timelines. For example, telling yourself you want to save UGX 15 million by December 2025 to fund your MBA at Makerere is far more concrete than simply saying you intend to save more. This is where products like the NSSF SmartLife Flexi come in to help you name your goal and determine a savings target, frequency, and period.

2. Measurable progress

Structured plans usually incorporate specific milestones. Such milestones might include clearing a loan balance within six months or reaching a certain net worth by mid-year. These measurable markers allow you to track achievements, spot any deviations, and make the necessary adjustments before small shortcomings become large setbacks in your financial journey.

3. Resource optimisation

A detailed plan compels you to evaluate your resources carefully — time, money, and even emotional energy, and to allocate them effectively. When you budget, you are effectively deciding how to distribute your limited income across immediate necessities (rent, food), medium-term needs (emergencies, your bucket list), and long-term goals (retirement, real estate). A structured plan ensures that you do not lose sight of any of these timelines, ensuring a more holistic approach to personal finance.

4. Accountability

Another key benefit of structured planning is the sense of accountability it forces you to have. Documenting your goals—whether in a notebook, spreadsheet, or product like the NSSF Smartlife Flexi turns them from wishes into commitments. This sense of responsibility can be further increased by sharing these commitments with a trusted friend or even family members to increase your motivation.

Free Personal Finance Tools for 2025

Now that you have an idea of how to plan and strategize, you will need some tools to help you keep track of your finances. Having a bird’s eye view of how you are progressing is important so that you are not working with assumptions. Here are some tools that can help.

Monarch money

Monarch Money is a comprehensive personal finance app designed to simplify financial management. It offers features like budgeting, investment tracking, net worth calculations, and goal setting, all within a user-friendly interface. It features an all-in-one dashboard that consolidates accounts, loans, and investments for a real-time financial snapshot. Customizable budgets, collaborative planning for households allows partners or family members to view, manage, and coordinate finances together. Its goal-focused tools help you set long-term targets, such as saving for a house deposit or paying off debt and monitor progress towards each milestone. Monarch’s holistic approach appeals to users seeking a complete view of their finances, making it ideal for individuals and families managing shared financial goals.

NSSFGo App

NSSFGo is a mobile application developed to help users plan and manage their finances with a particular focus on retirement savings and short to medium-term financial goals. By integrating loan amortisation tools, goal-based savings (SmartLife Flexi), and retirement projections, NSSFGo aims to offer both short-term and long-term financial solutions in one place. Whether you are looking to pay off a loan strategically or build an emergency fund, the app provides clear, user-friendly functionalities to keep your finances on track. Its key features include the following.

- Loan amortisation: This section helps you easily calculate monthly repayments, total interest, and payoff timelines for personal or home loans.

- SmartLife Flexi (Goal-based Savings): This section offers flexible savings plans that align with specific life goals, from education funds to home ownership. SmartLife Flexi allows for adjustable contribution amounts and timelines, ensuring the savings process adapts to your changing financial situation.

- Retirement projection: This section projects future retirement savings based on current contributions, and potential investment growth projected. The app offers goal-based and salary-based “what-if” scenarios that let you see how adjusting contribution amounts or changing retirement targets affect your final retirement fund.

NSSFGo’s holistic approach sets it apart from many budgeting apps that might overlook the intricacies of social security contributions. The app is available on App Store, Google Play or web via https://nssfgo.app

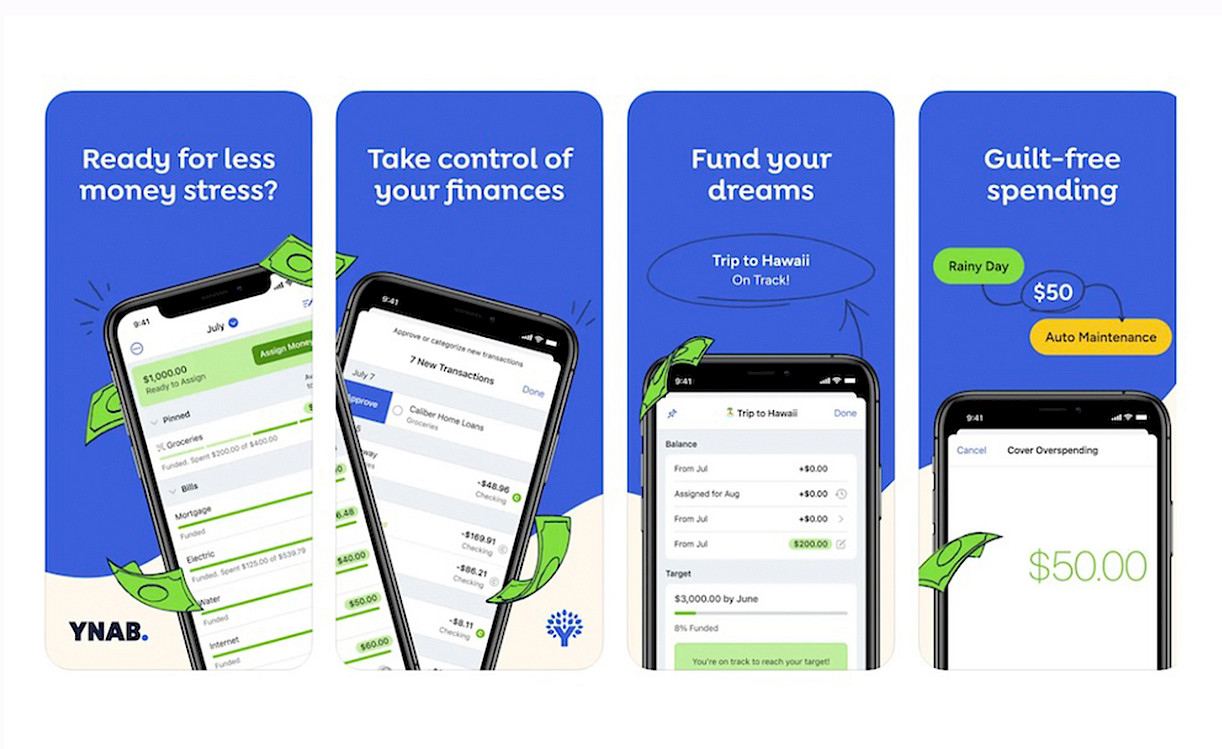

YNAB (You Need a Budget)

Focused on proactive budgeting and expense tracking, YNAB helps users develop healthy financial habits by allocating income to specific categories as soon as it arrives. This approach allows for more strategic spending and long-term financial stability. Its features include the following.

- Zero-based budgeting: You allocate every shilling you earn to a specific category, ensuring you’re intentionally directing your funds.

- Goal tracking: With this section, you get to define savings goals for monthly bills, holidays, or debt pay-off, and track progress clearly.

- Educational resources: This includes free workshops and an active community that help build strong budgeting habits and financial literacy.

- Age your money: This allows you to gradually create a buffer as you aim to use money earned at least 30 days prior, thus breaking the paycheque-to-paycheque cycle.

PocketSmith

PocketSmith is a personal finance and budgeting application designed to help individuals visualise their financial future. Unlike many conventional budgeting apps that focus primarily on historical spending, it employs a calendar-based system where you can forecast cash flow and create long-term projections, helping you make strategic decisions for savings and investments.

MoneyManager Ex

MoneyManager Ex is a free, open-source personal finance tool available on multiple platforms, including Windows, macOS, Linux, on desktops, laptops, and mobile. Known for its intuitive design and powerful tracking features, it caters to budget-conscious users seeking a versatile and reliable solution.

Google Sheets

Google Sheets has become a popular tool for budgeting and expense tracking due to its simplicity, flexibility, and cost-free accessibility. Its features include fully customizable spreadsheets for creating formulas, charts, and layouts tailored to track expenses, debts, and savings goals; real-time collaboration for sharing and updating sheets with others; free templates like monthly budget planners; and cloud-based access, enabling use from any device with an internet connection. Unlike subscription-based apps, Google Sheets offers unparalleled versatility, allowing users to control every aspect of their budgeting process, create custom reports, and enhance visualizations when paired with tools like Looker Studio.

Here are some of its features:

- Cross-platform compatibility: This allows you to use the tool on desktops, laptops, or mobile devices for seamless financial tracking.

- Open-source: You can benefit from a community-driven platform that’s continually improved by contributors worldwide.

- Budgeting and expense tracking: This section helps you categorise transactions, set spending limits, and generate detailed reports.

- Investment portfolio tracking: Keep tabs on shares, bonds, and other assets like Sacco deposits to measure overall financial performance.

Choose what works best

Each finance app or platform excels in its own way — from YNAB’s robust zero-based budgeting to MoneyManager Ex’s open-source flexibility. When choosing the right tool, consider your financial goals, comfort with technology, budget, and collaboration needs. By aligning an app’s features with your personal preferences, you’ll find managing money more intuitive and rewarding.

Most apps listed here have free versions, though some require subscriptions for premium features. However, NSSFGo and MoneyManager Ex are fully available at no cost. Note that apps supporting bank account links may not work with local banks, but you can still add those accounts and mobile money wallets manually and adjust balances as needed. Needless to say, no tool can replace the expertise of a licensed financial advisor, so if you can, consult professionals to review your finances and guide you on using these tools optimally in 2025.