To Wean Off Foreign Borrowing, Uganda’s Long-term Savings to GDP Must Rise to 25%

Thursday, February 6 2025 3:51 pm

By Victor Karamagi - Senior Manager Public Relations Follow on LinkedIn

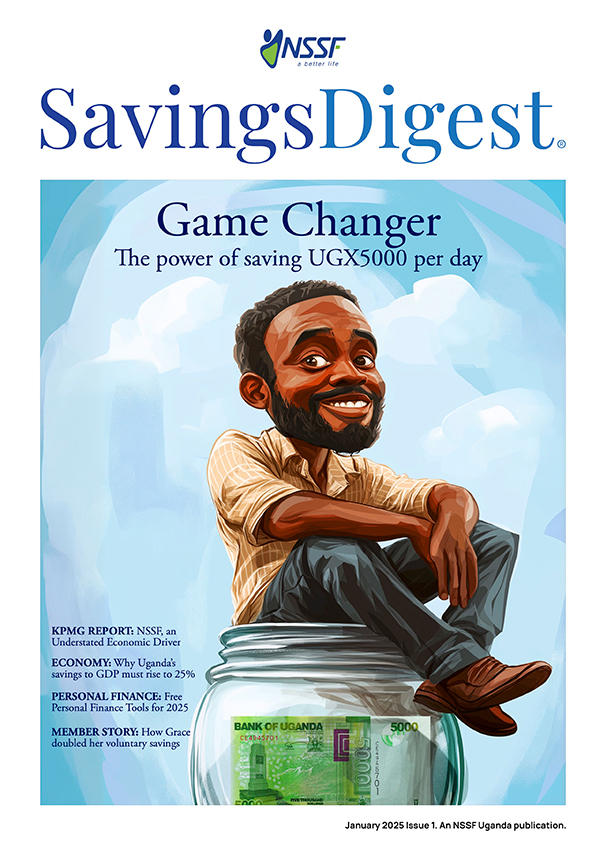

The NSSF recently launched a voluntary savings product, which it hopes is the start of the journey to expand social security coverage and accelerate Uganda’s long-term domestic savings to GDP. In this interview, the Fund’s Managing Director, Patrick M. Ayota, discusses why Uganda must double her long-term savings to GDP.

You have mentioned on several occasions that for Uganda’s development journey to accelerate truly, our savings to GDP must increase to at least 25%. What is magical about 25%?

For a country to achieve a certain level of economic development, many factors must be at play, and the domestic long-term savings to GDP is one of the most important. Taking the example of countries such as the East Asia giants and, lately, the Gulf states, higher domestic long-term savings to GDP contributed significantly to accelerated economic growth. Countries such as Vietnam, Singapore, Malaysia and even China began to take off economically after their savings to GDP accelerated significantly.

The figure that has been cited severally and has been identified as the magic point, at least for case study countries such as Vietnam is 25%. In Uganda, our long-term domestic savings to GDP is only 11%, and we must strive to grow the savings rate to at least 25%. The most obvious advantage is that we can start providing most of the necessary budget support from domestically mobilized resources, instead of relying on foreign funding that comes with very stringent and sometimes unrealistic conditions.

Vietnam is one of your favourite reference points for Uganda, why is that so?

An analysis of both Uganda and Vietnam shows that both countries were at the same level of economic development in 1986, which was the year the post-war recovery started. In addition, and more importantly, Vietnam was a mirror of Uganda in many ways at that time. For instance, historically, both countries were agrarian societies, and both were emerging from devastating wars – the bush war for Uganda, and the American invasion and civil war in Vietnam. Both countries were major coffee (and other cash crops) exporters, both had revolutionary leadership, and, both are gifted in natural resources.

Most importantly, both countries undertook almost similar reforms post-1986: both liberalized their economies to market forces, looked to attract Foreign Direct Investment (FDI), pursued a deliberate policy on value-addition and industrialization, and deliberately emphasized export-led growth policies.

Today, Uganda’s GDP is over USD 55 billion, with a savings rate of about 11% of GDP, almost exactly where Vietnam was in 2004. Vietnam GDP is about USD 550 billion with savings rate of almost 35%.The key question is: how has Vietnam experienced accelerated economic growth compared to Uganda? Both countries undertook similar reforms.One of the answers lies in mobilisation of long-term domestic savings. Vietnam began to take off economically after its long-term savings to GDP topped 25%. The high rate of long-term domestic savings to GDP is not the only factor, but it is certainly one of the important ones. This is because it provides affordable and accessible long-term funding for key projects a government may prioritise, be it infrastructure, agriculture, etc.

What is the Fund doing as the leading mobiliser of long-term domestic savings to ensure the country achieves the Vietnam miracle?

We have developed “Vision 2035”, premised on achieving UGX 50 trillion, onboarding 50% of Uganda’s working population into the social security net, and while we do that, achieving 95% customer and staff satisfaction. We are confident that by emphasizing the expansion of coverage to 50% of the working population, we can significantly contribute to increasing the savings rate. Our focus is on maximizing coverage and contributions by creating a willingness to save and building the capacity of Ugandans to save. To make headway, you will see us take the lead in what you may call non-traditional areas for us, such as support to agriculture, energy development, oil and gas, if the opportunities create value for the Fund.

We are already a leader in supporting entrepreneurship through our NSSF Hi-Innovator programme where we’ve already disbursed over UGX 25 billion to 360 small and growing businesses and created over 170,000 direct and indirect jobs. The private savings schemes are also critical, which is why we encourage Ugandans to embrace additional voluntary savings schemes along with the mandatory NSSF. Of course, there are other important policy issues the government must ensure are resolved.

What incentives should the policymakers in government and Parliament consider, to boost the savings-to-GDP?

Private sector-led growth policy does not necessarily mean that the state should leave the sector to carry the growth burden. So, the state must intervene in key sectors, especially agriculture – to address both the demand and supply sides. Right now, the government is focused on the supply side. Agriculture contributes over 24 percent of Uganda’s GDP, and employs over 70% of the population, so it makes sense to bring this segment of the population into the long-term savings bracket. The Fund is very keen to partner with the government for an intervention that works.

Secondly, the other obvious consideration would be to change the tax regime for savings schemes like NSSF. The current regime in Uganda, where the employee contributing is taxed, the Fund’s income is taxed, and the benefits tax-exempt (TTE) is not the most ideal and discourages savings at the contributions stage, as well as reducing the income available for distribution to members as interest, which also does not encourage savings.

The government needs to relook at the regime and introduce the most desirable, which is EEE – tax exemption at contributions, exemptions at scheme income, and exemption at payment of benefits to members. Change of the tax regime can encourage savings across the entire sector – both NSSF and private savings schemes. In the short run one may argue that this may create a funding gap to the Treasury. However our analysis shows that the economic growth fueled by this money contributes more to the Treasury in the long run.

Secondly, the government can consider tax incentives. For instance, any additional over and above a certain contribution rate, say 15%, can be tax-exempt even with the current tax regime. Another instance is providing tax incentives for people who save for longer periods.

Excluding the UPDF and parastatals, the civil service employs just over 388,850 people, who belong to the Public Pension Scheme. Should this scheme have a role in the quest to grow our long-term domestic savings?

The simple answer is yes. However, the government needs to first accelerate the reform of the public pension scheme to make it contributory. As currently constituted under the Pensions Act, the scheme’s main challenge is sustainability mainly because it is non-contributory and, therefore, continues to suffer funding shortfalls.

To cure this and to ensure it is a significant contributor to domestic long-term savings, it should be reformed so that civil servants can contribute to their pensions in addition to government contributions.

In NSSF, the government has a benchmark to follow to run a successful, profitable, and sustainable scheme. I hope the proposed reforms as envisaged in the Public Service Pension Fund Bill can be fast-tracked for the benefit of everybody and the country at large.

A lot has been said about the potential of the informal sector to drive savings rates in Uganda, where do you stand in that debate?

The potential is immense. The informal sector currently employs about 8,776,488, according to the UBOS National Labour Force Survey of 2021. Assuming a conservative growth rate of about 3%, you have more than 12 million employees over the next 10 years. This presents us with a huge opportunity.

We have already introduced a savings product – the NSSF Smartlife Flexi, which targets the informal sector and the self-employed. Just over a month after we launched the product, over 9,000 people enrolled and contributed over Ugx 3 billion shillings, mostly from the self-employed workforce. However, the informal sector must be assisted and incentivized to formalize and monetize the sector activities, what President Museveni calls the “money economy”. Only then can we truly realize the potential.

“I cannot save because I do not earn a good income.” Truth or myth?

Many people think that because one has a very low, sporadic income, they cannot save. It is a myth. The adage that says it is not how much you earn but how much you keep rings very true in this context. Any person who earns an income, however small, can still save. You must choose between instant gratification or a better tomorrow when that rainy day comes.

I would, therefore say, start by making a budget of all your expenditures in, say, a week or month. Next, review your budget and remove items that you can survive without (every budget has such items), and lastly, review one last time and retain only the essential items. By doing this simple exercise, one can discover that at whatever income level, anybody can save for that unforeseen situation. Fortunately, the NSSF Smartlife Flexi savings plan offers an opportunity for savings starting at as low as Ugx 5,000. I encourage Ugandans to visit our website, walk into any of our branches, or call us on a toll-free line 0800286773 to start a tailored savings journey.

“I am wondering whether I should open a retirement savings account given that in Uganda, people do not live long enough to benefit from their retirement savings.” Truth or myth?

This is a myth – and I can use two metrics to show how. The first is from the latest National Population and Housing Census, 2024, which shows that the overall life expectancy at birth is currently 68.2 years - 66.9 years for males and 70.1 years for females. So on average, Ugandans live to be about 70 years, yet those in formal employment retire at 55 or 60 years. You need a retirement savings plan for your old age.

Secondly, looking at our data at the Fund, less than 2% of our benefits are paid to “survivors”, that is, dependents of those who passed away. Again, there is a more than 98% chance that if you save with NSSF, you will live long enough into retirement if you are in formal employment and well into old age if you are in the informal sector. A retirement savings plan is not just desirable but also a necessity.